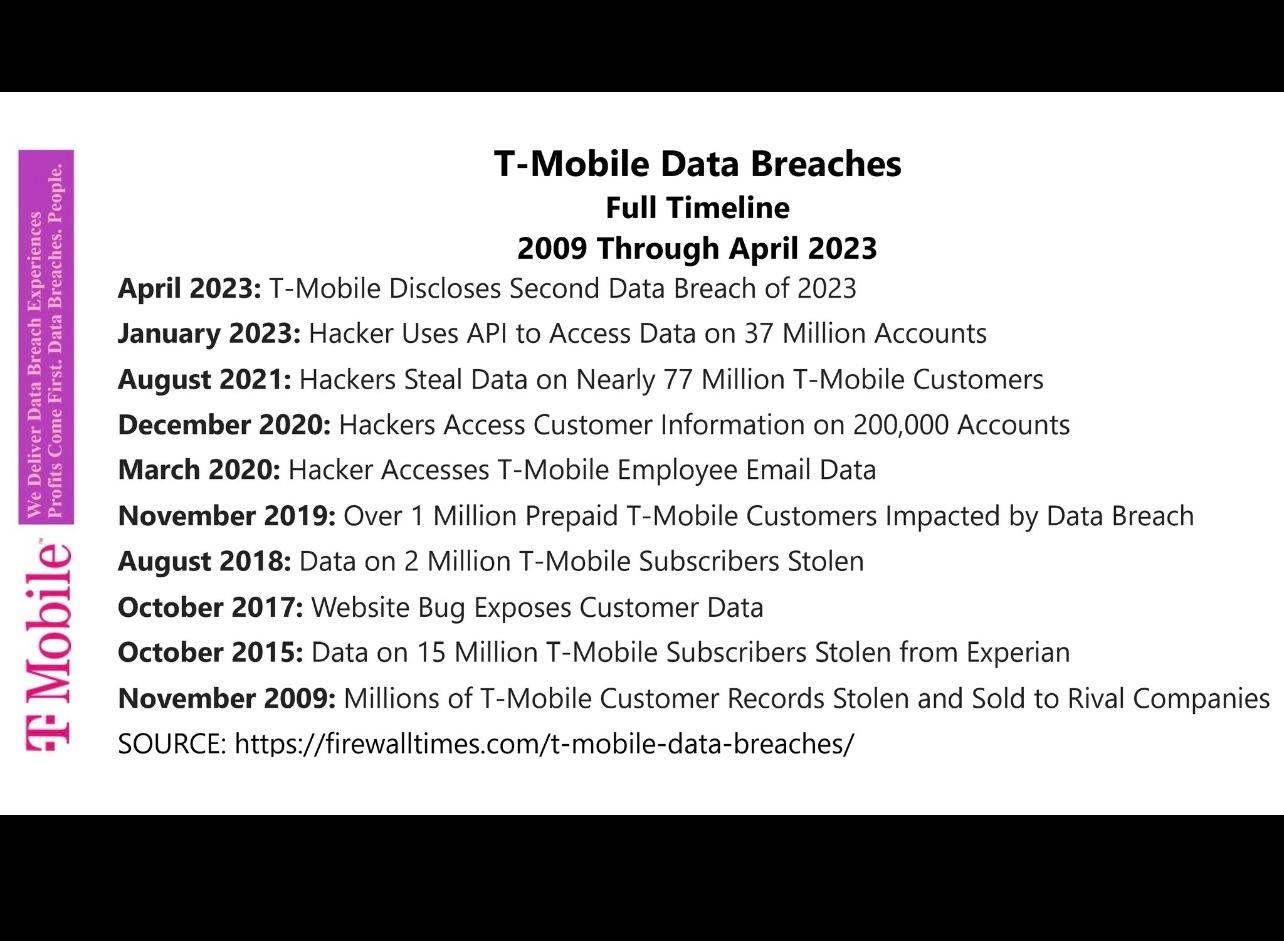

I just literally signed up for a new plan - debit cards have fees for providers too - accessing my bank account isn’t a good approach from a security perspective (noting that T-mobile has been hacked - i wouldn’t have shared this directly with T-mobile customer service but there is not email or chat and I don’t have time for phone calls

Action Needed:

Update your payment method to receive your AutoPay discounts |

|

ACTION NEEDED by 07/17/2023. We’re making changes to the payment methods that qualify for AutoPay discounts. To continue receiving the $25.00 AutoPay discount, you must update your payment method to a debit card or a bank account.

Visit your T-Mobile account to update your payment method and keep your discount by 07/17/2023. |

|